News

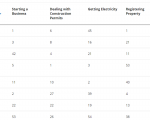

Economies are ranked on their ease of doing business, from 1–190. A...

Italian company Azimut Yachts enter Georgia, deputy head of Azimut-Benneti, Stefano Crescenzi...

Compared to the same time last year Georgian Airports have seen 28%...

Publications

The Strategic Secret of Private Equity

Private equity. The very term continues to evoke admiration, envy, and—in the hearts of many public company CEOs—fear. In recent years, private equity firms have pocketed huge—and controversial—sums, while stalking ever larger acquisition targets. Indeed, the global value of private equity buyouts bigger than $1 billion grew from $28 billion in 2000 to $502 billion in 2006, according to Dealogic, a firm that tracks acquisitions.

Risk Management…the What, Why, and How

Risk Management is the process of identifying, analyzing and responding to risk factors throughout the life of a project and in the best interests of its objectives. Proper risk management implies control of possible future events and is proactive rather than reactive. Proper risk management will reduce not only the likelihood of an event occurring, but also the magnitude of its impact. I was working on the installation of an Interactive Voice Response system into a large telecommunications company.

Events

INVESTORS' SEMINAR - ASIA 2018

An Invest Europe-led delegation will be travelling to Seoul and Tokyo to deliver practical insight into the investment opportunities in Europe. With investors in Asia looking towards other regions to deliver value and long-term returns, the Investors’ Seminar provides a comprehensive educational and networking platform to explore the private equity landscape in Europe, the sectors and regions primed for growth and the intricacies of identifying the right investment and partner.

NAIC Institutional Investor Forums

These forums also give potential investors an opportunity to connect with NAIC members and provide a platform to discuss manager performance, investment strategies and relevant emerging manager programs. These exclusive events are for institutional investors, government officials, and C-level investment executives who want to interact and build relationships.

trainings

Private Equity Masterclass Series

The EMPEA Private Equity Masterclass is an opportunity for fund managers to gain practical insight from emerging markets private equity’s largest investors. Whether you have funds in the market or are looking to sharpen your market intelligence for the next round, this Masterclass will provide you with real world fundraising perspectives, lessons learned, legal strategies and industry best practices. We would like to thank our global thought leader and supporter Debevoise & Plimpton.

INVEST EUROPE TRAINING

This training course offers practical knowledge and provides delegates with guidance on implementing responsible investment related strategies and processes, relevant for both the GP and the LP community.

The course leaders, who are industry experts on responsible investment from the LP, GP and advisory communities and are actively involved in Invest Europe’s Responsible Investment Roundtable, tailor the content of the course on a yearly basis, giving emphasis on practical examples, discussion of case studies and day-to-day challenges, with attention to the specificities of both venture capital and buyout.

Oxford Impact Investing Programme 2019

The Oxford Impact Investing Programme is a world leading executive development programme at the University of Oxford’s Saïd Business School. It is the most comprehensive programme available for professionals from financial institutions, foundations, NGOs, impact investing funds and social enterprises to come together and develop best practice in this exciting and emerging field.

communities

EMPEA

EMPEA is the global industry association for private capital in emerging markets. An independent, non-profit organization, the association brings together 300+ firms—including institutional investors, fund managers and industry advisors—who manage more than US$5 trillion in assets across 130 countries. EMPEA members share the organization’s belief that private capital can deliver attractive long-term investment returns and promote the sustainable growth of companies and economies. EMPEA supports its members globally through authoritative research and intelligence, conferences, networking, education and advocacy.

About Houston Private Equity Association

Houston Private Equity Association was founded in 1983 as the Houston Venture Capital Association. The organization voted in 2005 to change its name to the HPEA, which more accurately reflects its membership. Member firms manage risk equity capital for investment in venture capital, mezzanine, buyouts, and other private equity transactions. The firms represent the gamut from early- and mid-stage to late-stage capital providers.

Invest Europe

Invest Europe is the association representing Europe’s private equity, venture capital and infrastructure sectors, as well as their investors

NAIC

The NAIC is the trade association focused on attracting greater levels of capital to high-performing diverse-owned investment management firms. The NAIC executes this plan through advocacy, introductions to institutional investors, custom research and studies.